Get Quick Cash Loan: The Ultimate Guide

What do you mean by a quick cash loan?

A quick cash loan is a type of short-term loan that provides borrowers with the funds they need in a fast and efficient manner. These loans are typically used for emergency expenses or unexpected financial situations where immediate access to cash is necessary. Quick cash loans are known for their quick approval process and fast disbursal of funds, making them a popular choice for those in need of quick financial assistance.

How can you get a quick cash loan?

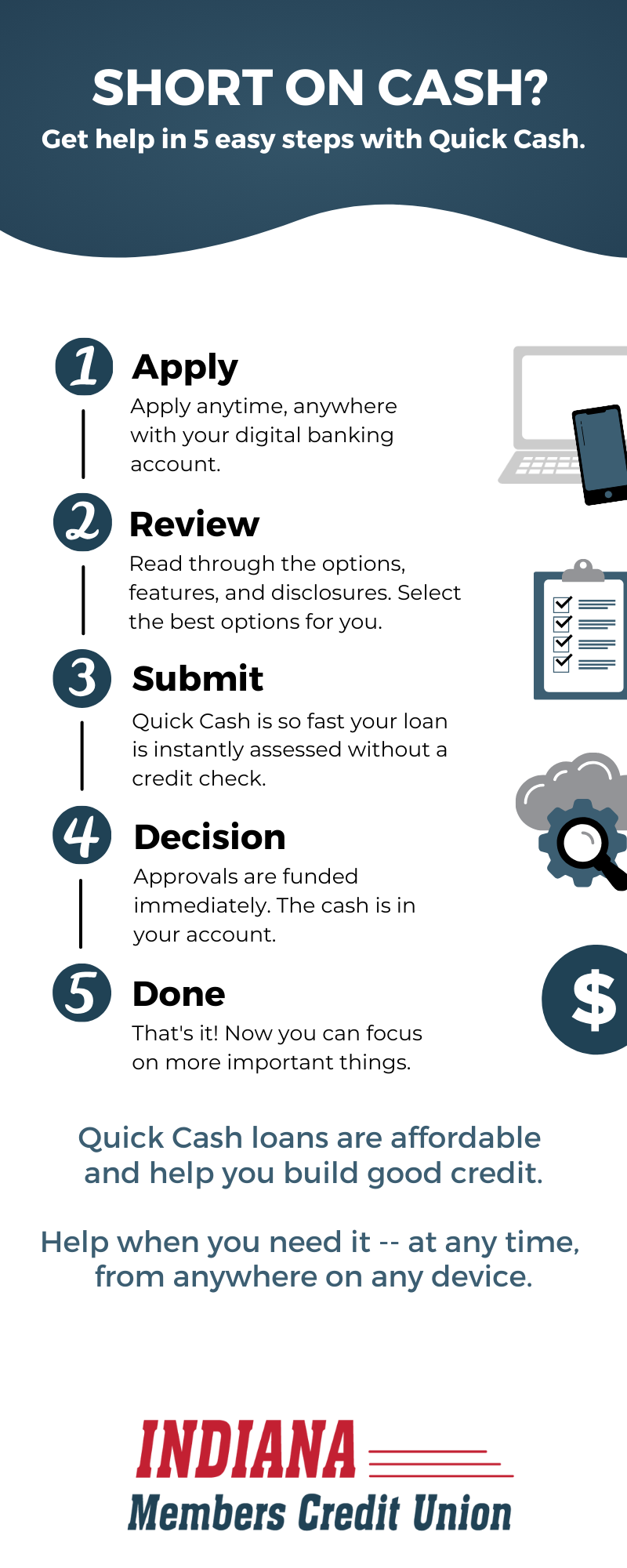

Getting a quick cash loan is a relatively simple process that can be completed online or in-person at a financial institution. To qualify for a quick cash loan, borrowers typically need to meet certain eligibility criteria, such as having a steady income, a valid ID, and a bank account. Once the borrower has met the eligibility requirements, they can fill out an application form and submit it for approval. The lender will then review the application and make a decision on whether to approve the loan.

What is known about quick cash loans?

.png)

Image Source: imcu.com

Quick cash loans are known for their high interest rates and fees, which can make them a costly form of borrowing. It’s important for borrowers to carefully read and understand the terms and conditions of the loan before agreeing to it, to ensure that they can afford to repay the loan in a timely manner. Failure to repay a quick cash loan on time can result in additional fees and charges, as well as damage to the borrower’s credit score.

What is the solution for those in need of quick cash?

For those in need of quick cash, a quick cash loan can be a viable solution to their financial problems. These loans provide borrowers with immediate access to funds, allowing them to cover emergency expenses or unexpected bills. However, it’s important for borrowers to use quick cash loans responsibly and only borrow what they can afford to repay, to avoid falling into a cycle of debt.

Information about quick cash loans

Quick cash loans are typically unsecured loans, meaning that borrowers are not required to provide collateral in order to qualify for the loan. This can make them a convenient option for those who do not have valuable assets to use as security. However, because quick cash loans are unsecured, they often come with higher interest rates than traditional loans, so borrowers should be prepared to pay more in interest over the life of the loan.

FAQs

1. How quickly can I get a quick cash loan?

Quick cash loans are designed to be fast and efficient, with many lenders offering same-day approval and funding. However, the speed at which you receive your funds will depend on the lender and their specific application process.

2. What are the eligibility requirements for a quick cash loan?

Eligibility requirements for quick cash loans vary by lender, but typically include having a steady income, a valid ID, and a bank account. Some lenders may also require a minimum credit score or a certain level of income to qualify for a loan.

3. Can I use a quick cash loan for any purpose?

Quick cash loans can be used for a variety of purposes, including emergency expenses, car repairs, medical bills, or any other unexpected financial need. However, it’s important to use the funds responsibly and only borrow what you can afford to repay.

4. What happens if I can’t repay my quick cash loan on time?

If you are unable to repay your quick cash loan on time, you may incur additional fees and charges, as well as damage to your credit score. It’s important to contact your lender as soon as possible if you are experiencing financial difficulties, to discuss your options and avoid further penalties.

5. Are quick cash loans safe?

Quick cash loans can be a safe and convenient option for those in need of quick financial assistance, as long as they are used responsibly. It’s important to carefully read and understand the terms and conditions of the loan before agreeing to it, to ensure that you can afford to repay the loan in a timely manner.

get quick cash loan