Purchase Money Loan: Everything You Need to Know

What is a Purchase Money Loan?

A purchase money loan is a type of loan that is used to finance the purchase of a specific item, typically real estate. This type of loan is different from a traditional mortgage loan, as it is specifically tied to the purchase of the item in question. In the case of real estate, a purchase money loan is used to fund the purchase of a home or property.

How Does a Purchase Money Loan Work?

When you take out a purchase money loan, the lender provides you with the funds needed to purchase the item. In the case of real estate, this loan is typically used to cover a portion of the purchase price of the home or property. The buyer then repays the loan to the lender over a set period of time, usually with interest.

What is Known About Purchase Money Loans?

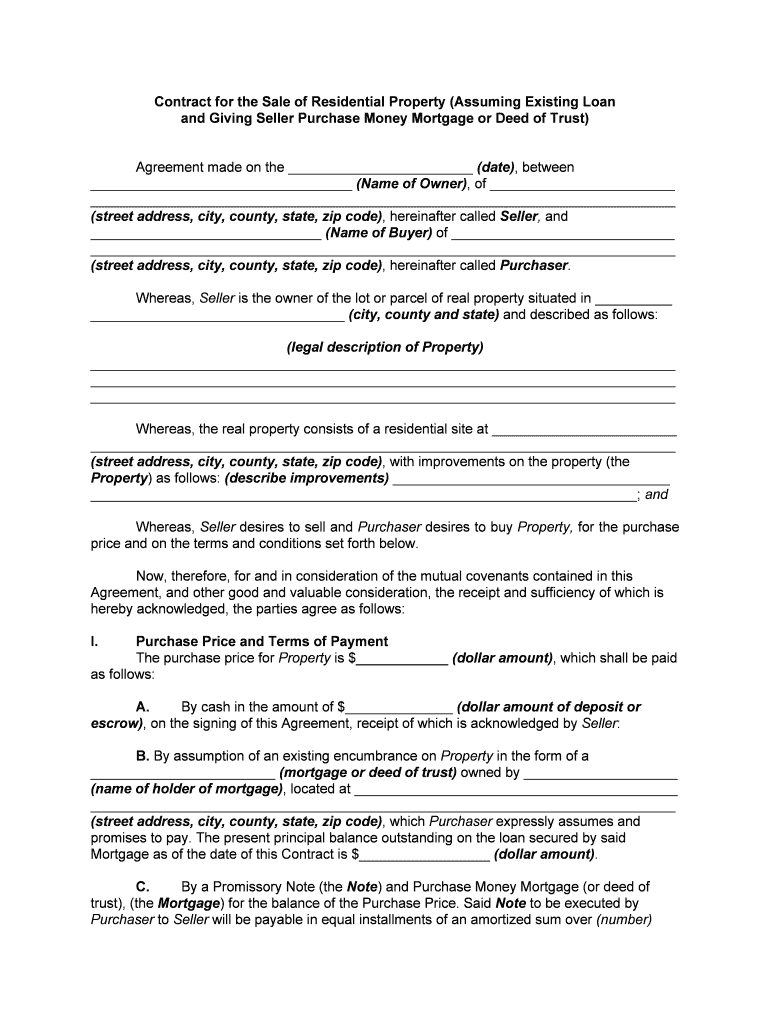

Image Source: pdffiller.com

Purchase money loans are commonly used in real estate transactions, as they allow buyers to secure the funds needed to purchase a property. These loans are often used in conjunction with a down payment, with the buyer providing a portion of the purchase price upfront and financing the rest with a purchase money loan. This type of loan is typically secured by the property being purchased, meaning that if the buyer defaults on the loan, the lender has the right to foreclose on the property.

What are the Benefits of a Purchase Money Loan?

There are several benefits to using a purchase money loan to finance the purchase of a home or property. One of the main benefits is that these loans can often be easier to qualify for than traditional mortgage loans, as they are specifically tied to the purchase of the item in question. Additionally, purchase money loans can sometimes offer more flexible terms and lower interest rates than traditional mortgage loans, making them a popular choice for many buyers.

How to Obtain a Purchase Money Loan

To obtain a purchase money loan, you will need to apply with a lender who offers these types of loans. The lender will review your financial information, credit history, and the details of the purchase to determine if you qualify for the loan. If approved, the lender will provide you with the funds needed to purchase the item, and you will begin making payments according to the terms of the loan agreement.

Conclusion

In conclusion, a purchase money loan is a type of loan that is used to finance the purchase of a specific item, typically real estate. This type of loan can offer several benefits, including easier qualification requirements and more flexible terms than traditional mortgage loans. If you are considering purchasing a home or property, a purchase money loan may be a good option to help you secure the funds needed for the purchase.

FAQs

1. Can anyone qualify for a purchase money loan?

Qualifying for a purchase money loan will depend on your financial situation, credit history, and the details of the purchase. While these loans can sometimes be easier to qualify for than traditional mortgage loans, not everyone will meet the lender’s requirements.

2. What is the difference between a purchase money loan and a traditional mortgage loan?

A purchase money loan is specifically tied to the purchase of a specific item, while a traditional mortgage loan is not tied to a specific purchase. Additionally, purchase money loans can sometimes offer more flexible terms and lower interest rates than traditional mortgage loans.

3. What happens if I default on a purchase money loan?

If you default on a purchase money loan, the lender has the right to foreclose on the property being purchased. This means that the lender can take possession of the property and sell it to recoup the funds loaned to you.

4. Are there any downsides to using a purchase money loan?

While purchase money loans can offer several benefits, there are also potential downsides to consider. These loans may have higher interest rates than traditional mortgage loans, and the property being purchased is typically used as collateral, meaning that you could lose the property if you default on the loan.

5. Can I use a purchase money loan for purposes other than real estate?

While purchase money loans are commonly used in real estate transactions, they can also be used to finance the purchase of other items, such as a car or boat. However, the terms and requirements of the loan may vary depending on the item being purchased.

purchase money loan